Share investing earns you dividends

Take advantage of the dividend return of shares – dividends matter! Each company decides when and how regularly they want to pay dividends to shareholders. Dividends are usually paid in cash and are declared as a specific amount for every share held on the declaration date for that specific dividend.

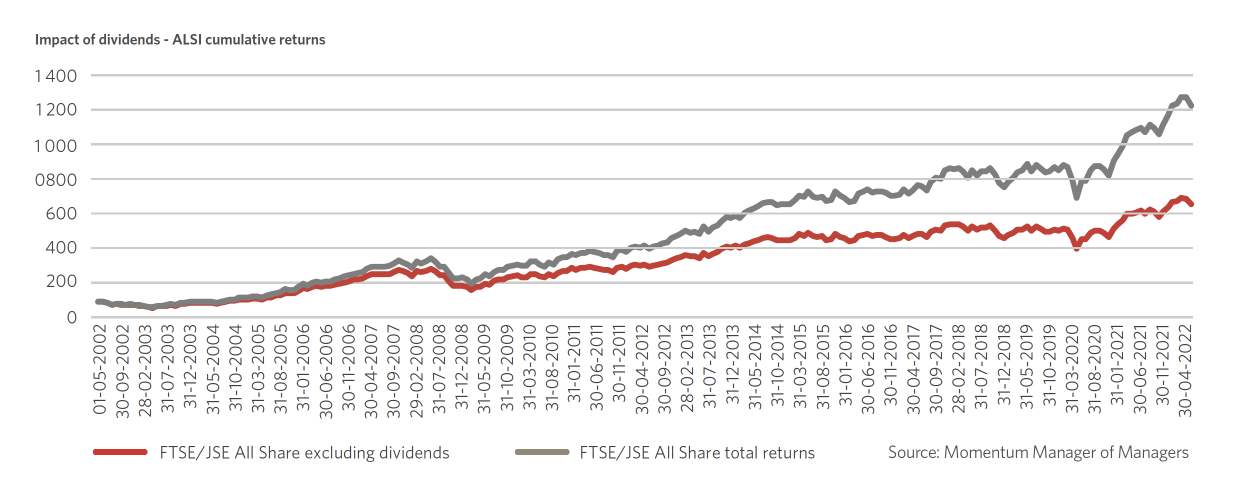

Shareholders can then choose to buy more shares in their share portfolio with the dividend amount they get. When you get dividends and invest them in more shares, you earn dividends on those shares too. This is generally called the compounding effect of dividends reinvested.

The dividends a company paid out over the past year (as a percentage of the share price) is called the dividend yield. Dividends, together with the fluctuation in share price, are the 2 main drivers of your investment return.

The FTSE/JSE All Share Index (ALSI)

The FTSE/JSE All Share Index (ALSI) is a good representation of the market value of all the ordinary shares listed on the main board Johannesburg Stock Exchange (JSE). It contains the leading 164 shares listed on the JSE, measured by their market capitalisation (share price multiplied by the number of shares).

The ALSI was designed to show the movement of our equity market. The next graph of the ALSI shows how you can increase your return over the long term by reinvesting dividend payments, to see the effect of compounding in the cumulative total investment return.

Other benefits

Diversify the risk in your investment portfolio

Investment risk is not only the risk of losing your investment capital, but also of not meeting your investment goals. It is important to always blend your investment asset allocation to make sure you meet your investment goals of earning an investment income, protecting your investment capital, or growing your investment.

Shares attract lower tax

Your investment in shares has 2 different sources of investment return: the growth because of the change in the share price and the dividends the companies pay. The gain is a capital gain and only a part of it is taxed. In addition, dividend withholding tax (DWT) is withheld at a rate of 20% from all dividends you get from South African companies. The benefit lies in paying tax on only a part of your gain and on only a percentage of your dividend, which is less than the income tax you would pay on any interest-earning investment.

Shares give you the best chance of beating inflation over the long term

Average household expenses like electricity, food, petrol and entertainment are increasing faster than we think. We find that our money pays for less every month, mainly because of the eroding effect of inflation on these expenses. It is therefore very important for you to consider the effect of inflation on your investment capital.

Did you know?

Start investing in shares with Momentum Securities

We provide 3 different ways to start investing: