Choose how to manage your investments

Our diverse team of specialists are involved in the research and investment selection process, integrating both a macro and micro view into our advice. Our ongoing market analysis and research are shared with our clients daily.

As a member of the JSE, we are approved to trade in, and manage share investments on behalf of individuals and institutions. We have the expertise to assist you in every area of the market.

Discretionary (managed) portfolios

We'll manage your portfolio by making use of 1 of our core local or global investment profiles.

Local and Offshore Portfolios

We buy and sell securities on your behalf, taking your investment objectives and risk profile into consideration. Or, if you have specific objectives, a bespoke portfolio will be designed for your requirements. A minimum initial investment of R250 000 applies for local portfolios and a minimum initial investment of $20 000 applies for offshore portfolios. Should you be interested in our International Exchange Traded Note, a minimum initial investment of R5 000 applies.

While some listed Exchange Traded Funds (ETFs) offer offshore exposure, many clients prefer personalised segregated investment portfolios. Our range of offshore providers lets you select the solution that best meets your particular requirements, with access to all major global equity markets, ETFs and mutual funds.

Should you require more information regarding our managed local or offshore portfolios, please contact our client services team on 011 550 6270 or [email protected].

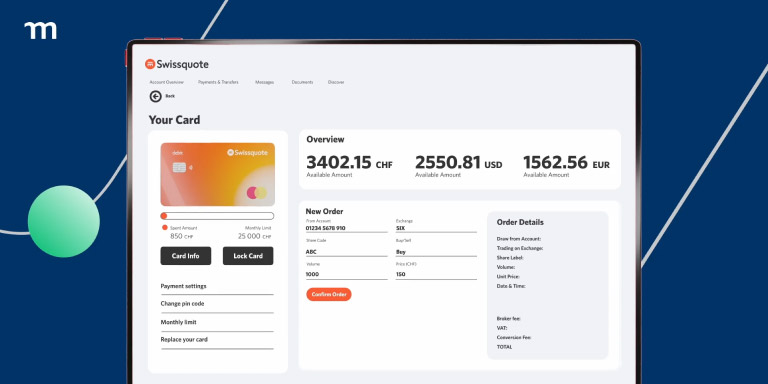

Swissquote partnership

A multi-currency debit card

1 card - 12 currencies

Momentum Securities’ relationship with our offshore provider, Swissquote, allows you to use their offshore platforms through your local portfolio manager relationship.

Advisory portfolio

Choose your level of involvement – our team of experts will guide you through the investment process letting you determine your desired level of involvement, while making informed decisions. A minimum initial investment of R250 000 applies.

Non-discretionary (self-managed) portfolio

Client-centric investment process where you lead the way. If you want to participate in the management of your investments, we let you take the reins. We are always available to execute your transactions or to discuss investment opportunities. No minimum investment amount is required.

Structured products

A structured product can be broadly defined as a pre-packaged

investment that combines multiple financial instruments into one

investment vehicle designed to meet specific investor needs and

objectives.

It generally consists of two main components such as an underlying

asset (such as an index or a basket of

securities) and a derivative

component which is used to customize the risk return and create

specific payoff

structures.

The structures may differ and could include: capital protection, income

generation, leveraging and participation. Each structure and component

will have its own characteristics and risk return profile. Many

participants classify structured notes as an alternative asset class;

however Momentum Securities would categorise structured notes as an

alternative to achieving investment goals by defining the expected

outcome before the investment is made.

Benefits

Diversification:

Exposure to a variety of underlying assets or alternative asset classesEnhanced returns:

Providing additional growthProtection:

Level of guarantees applied to the initial investment amountIncome generation:

Payable regularly throughout the termOur structured products

Securities-based lending (SBL)

Through the SBL facility, you can use the gearing power of your share portfolio to access the liquidity you need to act on important opportunities while keeping your long-term investment objectives intact. We accept Top 100 listed JSE shares and qualifying offshore portfolios, and Collective Investment Scheme holdings as collateral.

Benefits

- Streamlined application process (3-5 days approval process)

- No need to sell your shares to raise cash

- Securities and loan consolidated in 1 account

- No initial structure/administration charges, market-related interest rate

- No fixed repayment terms

- No pre-payment penalties

Asset administration

A vital component of a broking operation is the effective settlement and administration of your assets. Our services include:

- Management of assets and the holding of these assets with a registered Central Securities Depository Participant (CSDP) on behalf of a trust, corporate and individual clients.

- Administration of corporate actions on behalf of clients and the notification of clients with respect to the rights issues, share splits and name changes.

- Management of estate late evaluations ensuring that the stipulations in your Will are carried out.

Institutional investors

Trade in offshore markets

A passionate institutional team offers opportunities to trade in local and offshore markets. We aim to deliver effective and efficient service, drawing on our deep institutional and corporate experience.

We have established strong trading relationships with our institutional clients as well as leading in-country brokers to ensure that all trades are executed in the best interest of our clients.

Custody and settlement

We are able to provide custody at highly competitive rates, held through reputable global custodians. This includes processing cross-border securities trades and safekeeping your financial assets. We comply with the rules and regulations of the jurisdictions in which we operate. Our experienced and efficient team ensure that settlements occur smoothly, and the forex leg of any international transaction is processed timeously.

Investment vehicles

- Equities

- Exchange Traded Funds

- Derivatives

- Tax-free savings accounts

- Bonds

Equities

As a member of the JSE, we are approved to trade in, and manage share investments on behalf of individuals and institutions. We have the expertise to assist you in every area of the market.

Exchange Traded Funds

You are able to invest in ETFs and structured products listed on the JSE.

Derivatives

We can execute and provide advice on trading in all South African derivative products, from index futures and options to single-stock futures on JSE-listed shares, international stocks, CFDs, warrants and currencies.

Tax-free savings accounts

A low-cost solution that complies with tax-free savings account legislation. Investments are limited to R36 000 per year.